Lesson 4

Spot Grid Trading Techniques and Precautions

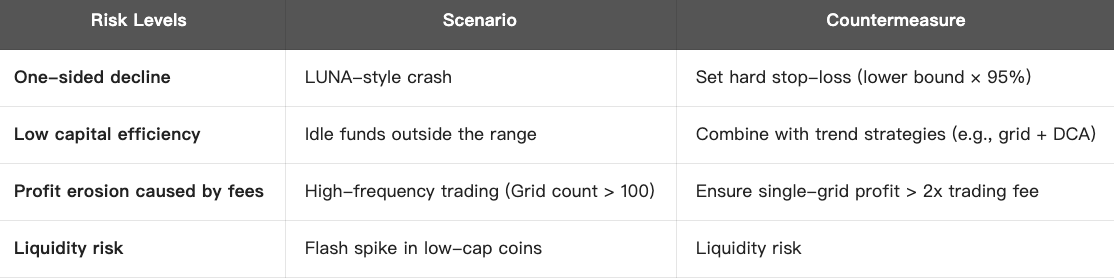

Although spot grid is a relatively conservative strategy, risks such as losses in one-sided markets and profit erosion caused by fees still exist. To improve bot performance, it is recommended to select mainstream coins, enable fee payment with other coins, adjust parameters dynamically, and set appropriate stop-loss and take-profit mechanisms. Additionally, market suitability, sudden events, and capital management are essential to sustaining long-term bot operation.

1. Risks and Limitations

- Losses in one-sided markets: Strict stop-loss settings are necessary to avoid continuous position accumulation when the price drops below the grid range.

- Low capital efficiency: Some funds may remain idle outside the range, which can be complemented by trend strategies.

- Profit erosion caused by fees: High-frequency trading should pay attention to costs (Gate fees are as low as 0.06% with fee payment with GT enabled).

2. How to Optimize Usage?

- Choose major coins with high liquidity, such as BTC or ETH, to reduce slippage and order delays.

- Set the price range and grid quantity based on coin volatility, using volatility indicators such as ATR(14) to ensure that per-grid profit covers fees and leaves a surplus.

- Enable fee payment with other coins (e.g., using GT for fee payment) to improve ROI.

3. Trading Techniques

- Set price range and grid spacing wisely: Determine a proper price range and grid spacing based on historical volatility and technical analysis. Setting them too wide or too narrow may both reduce profitability.

- Adjust dynamically: Regularly modify grid parameters based on market trends and order execution to maintain bot flexibility.

- Capital management: Ensure reasonable fund allocation per order. Avoid allocating too much to a single order. Set take-profit and stop-loss to prevent excessive losses during sharp market moves.

4. Key Considerations:

- Market selection: Grid bots perform best in sideways markets and may incur continuous losses in one-sided markets. Always monitor market trends and pause or make adjustments when needed.

- Risk control: Set appropriate stop-loss mechanisms to avoid position exposure risk from large market swings.

- Trading costs: Watch out for transaction fees and slippage, which may eat into the bot’s arbitrage margin.

- Market events: In the case of major news or abnormal market volatility, promptly disable auto-trading to avoid losses from execution delays.

- Diversify funds: Avoid allocating all capital to a single grid bot. Consider multi-strategy combinations to diversify risk.

Core Risks and Countermeasures

Disclaimer

* Crypto investment involves significant risks. Please proceed with caution. The course is not intended as investment advice.

* The course is created by the author who has joined Gate Learn. Any opinion shared by the author does not represent Gate Learn.